INDEPENDENT ASSET MANAGER

Victoria Peak Capital Management is an independent Global wealth management firm. We have offices in Switzerland with Head Office in

WHY VICTORIA PEAK CAPITAL MANAGEMENT?

Victoria Peak Capital Management is an experienced fixed income specialist that enables private investors the compilation of a professional portfolio, which is otherwise only possible for institutions, institutional investors and major accredited hedge funds.

INDEPENDENT ASSET MANAGER

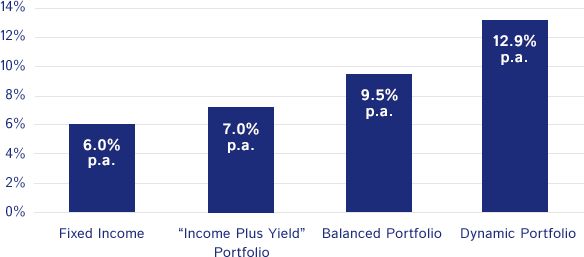

Annualized performance for all client accounts of Victoria Peak Capital Management during the period of 2012 until 2019 (in Euro)*

*The historic data is no guarantee of future performance. The above-mentioned performance results are net results (after deduction of all fees but before tax) and refer to all client accounts of Victoria Peak Capital Management.

CALLBACK SERVICES

OUR CLIENTS

We primarily work with international and Swiss private clients who are looking to invest over the medium- and long-term. We build a lasting business relationship with this circle of clientèle, which is based on regular dialogue and mutual trust. We accept management mandates starting from a minimum amount of 10,000 CHF/EUR/USD.

OUR APPROACHS

To us, every client is unique. It is important that we know the personal and financial situation of each individual client to ensure that the investments we offer meet their individual needs and expectations. We follow a conservative investment strategy, which means that we avoid speculative investments, because our objective is to secure our clients’ assets and increase them over the long-term.

OUR INVESTMENTS

We offer a wide range of financial investment opportunities. On the one hand, we offer fixed-rate corporate bonds to achieve constant interest income for our clients, and on the other, we also offer high-dividend value stocks, if these correspond to the target return and investment horizon of our clients. If necessary, these investment categories can be supplemented by alternative investments.

Contacts

Hong Kong:

Room 603 6 / F Winful Centre 30 Shing Yip Street

Kwun Tong District

HongKong

Switzerland:

Börsenstrasse 3, 8001 Zürich, Switzerland

phone: +41 435500233

Notices / Disclaimer

Victoria Peak Capital Management Europe is a member of the self-regulatory body, PolyReg, and thereby

The information contained